Why it pays to stay calm when markets are falling

Market crashes can test the resolve of the most seasoned fund manager, but history has a way of repeating, and with that comes an opportunity to learn valuable lessons to prepare you for the next fall.

If 2020 taught us anything, it was that markets can rise and fall in equal measure. One month you’re riding the crest of rising markets only to lose the gains in the next. The temptation to do something can feel overwhelming. To help you make sense of what to do when markets are in free fall, we’ve pulled together some of the key learnings from the experts who keep their cool no matter what the markets throw at them.

Learning #1: Short-term losses smooth out over time

When markets fall, as they did during the global financial crisis (GFC) and early days of COVID-19, single monthly losses in your KiwiSaver can seem significant. These moves, while large, are not necessarily alarming when taken in the context of a longer time frame.

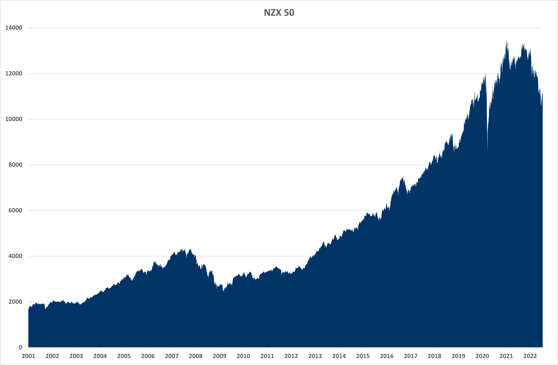

Chart 1 shows how the NZ equity market fared over the past 21 years, including times of significant market turmoil. What’s interesting to note is that no matter how great the short-term ups and downs were, over time they smoothed out delivering an upward trend for returns.

Source: Bloomberg

If you have time on your side and you're saving for a long-term goal, such as investing in your KiwiSaver for your retirement, chances are the best thing to do is to just continue through this environment as you would do if markets were stable.

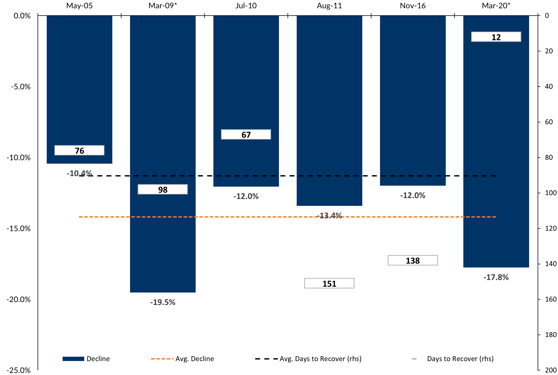

Learning #2: Markets do bounce back

Bear markets (when stock prices are falling) and recessions should be expected over a lifetime of investing. During these times of uncertainty, it’s important to remember that markets eventually recover and that by staying invested you will be well positioned to benefit from the rebound.

- Overall peak to trough decline during the GFC (Mar 2009) was -43%, where it entered into a bear market (i.e. a decline of -20% or more from the previous high), It took ~1.5yrs to recover this loss.

- The overall decline during the COVID-19 pandemic (Mar 2020) was -30%, which lasted a mere 21 days (21 Feb 2020 - 23 March 2020). It took 45 days to recover this loss.

Source: Forsyth Barr

Trying to pick the ‘right’ time to buy and sell as the economy goes through these periods of stress and strain is unlikely to be a good idea because it could mean you’re selling into a falling market—a sure-fire way to make a loss.

Learning #3: Think long-term, act long-term

When markets are falling, and you see your KiwiSaver balance drop, it’s natural to feel like you should be doing something. While making reactive changes might feel like you’re protecting your retirement savings, in the long run, it may have the opposite effect and lock in potential losses.

History suggests that members who stay invested through market ups and downs end up better off than those who switched investment options trying to chase returns or protect their investment.

If you think about the housing market in New Zealand when house prices fall people tend not to sell because they don’t want to make a loss. Instead, they’ll wait until house prices start to rise before selling. The same logic should be applied to the investment options in your KiwiSaver. When the share market falls you don’t want to be selling into those losses by switching.

Short-term ups and downs are normal with KiwiSaver because the value of assets that the fund invests in will fluctuate over time. While it can be tempting to change to a more conservative investment option like cash when you see your KiwiSaver balance decline, it’s important to stay focussed on the long-term. Work out an investment strategy that’s right for your personal objectives, situation, and needs, and stick to it. Don’t go changing it every time the market moves.

In conclusion: We're focused on you and your KiwiSaver

Staying strong when markets are weak can be a tough call, but it’s vital if you want to protect your investment from unnecessary losses.

To help you do this, we offer a range of premixed diversified funds, ranging from growth to conservative options. If you’re in one of these options you don’t need to worry about monitoring markets and managing your investment choices, as the Nikko AM investment teams do this for you. They monitor a range of indicators and manage changes in investment markets, as needed, to help protect and maximise your long-term returns.

.png?width=362&name=Ferg%20info%20centre%20(1).png)