Russia Ukraine Conflict

Following the Russian invasion of Ukraine, there has been considerable media coverage and interest about the implications this has on New Zealand investments. This invasion has seen devasting humanitarian effects. Our thoughts are with the people of Ukraine and those who have had family and friends affected by this crisis.

We’d like to share our thoughts on the current situation, what this means for your investment and what we are doing to minimise the Russian exposure in our funds.

The current situation

Russia is a major supplier of many commodities to the world, it supplies 12% of the world’s crude oil and approximately 40% of Europe’s natural gas, it also supplies 18% of wheat to the world. The conflict has affected the supply of these commodities, resulting in higher fuel prices, restricted gas supply in Europe and increased food costs for consumers across the world.

The price increases are due to many factors including imposed sanctions, self-imposed sanctions (made by many multinational companies), financial restrictions and transport delays.

Increasing inflation and interest rates have created a general uncertainty in global financial markets and in uncertain times markets tend to react negatively. The New Zealand market is not immune and has fallen this year. It’s difficult to predict what will happen over the coming months, but in these uncertain times the importance of active management of your funds remains prevalent.

How does this affect your investments?

During these unsettling times it may seem difficult to sit and do nothing with your investments. We’d just like to remind you that when you redeem your investments during market downturns, any losses become locked in. By sticking to a long-term plan, those losses have the opportunity to recover, More often than not, staying invested proves to be a better option.

What we are doing to prohibit investments into Russian listed securities

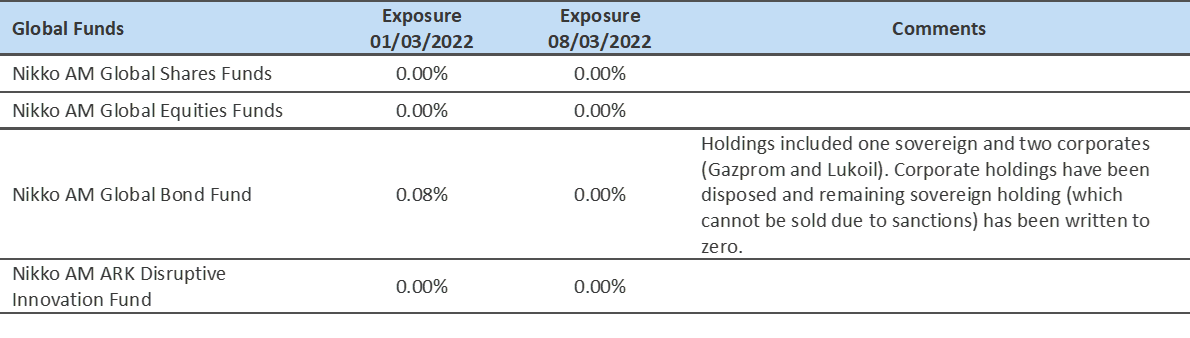

We recently passed a resolution to prohibit investment into any Russian listed securities, or Russian entities issuing in offshore markets. In the table below, we have detailed our exposure to such securities, and those sold in the past week. Please note that the residual negligible holdings are unable to be sold due to the sanctions currently in place.

In addition to this, there are broad structural impacts such as energy prices, interest rates and global sentiment which will affect all funds. In all cases, our investment teams will monitor these closely and moderate their investment decisions accordingly, another advantage to being in an actively managed fund. We will continue to keep you updated on this situation and if you have any questions or concerns please feel free to contact us.

.png?width=362&name=Ferg%20info%20centre%20(1).png)