James Kinghorn, Global Equities, Nikko AM

01 Dec 2021

Future Quality Insights - December 2021 - A trip to Lisbon

Just a few weeks ago I attended my first in-person conference since 2019. Over 40,000 people descended upon Lisbon for Web Summit, one of the world’s largest technology conferences. The event brings together CEO’s and founders of established firms together with start-ups and policymakers to discuss and pitch ideas over the course of a week. The last two years the summit has taken place virtually; in 2019, when I last attended, there were around 70,000 attendees. This year’s event was scaled back due to COVID-19 but was a sell-out, nonetheless.

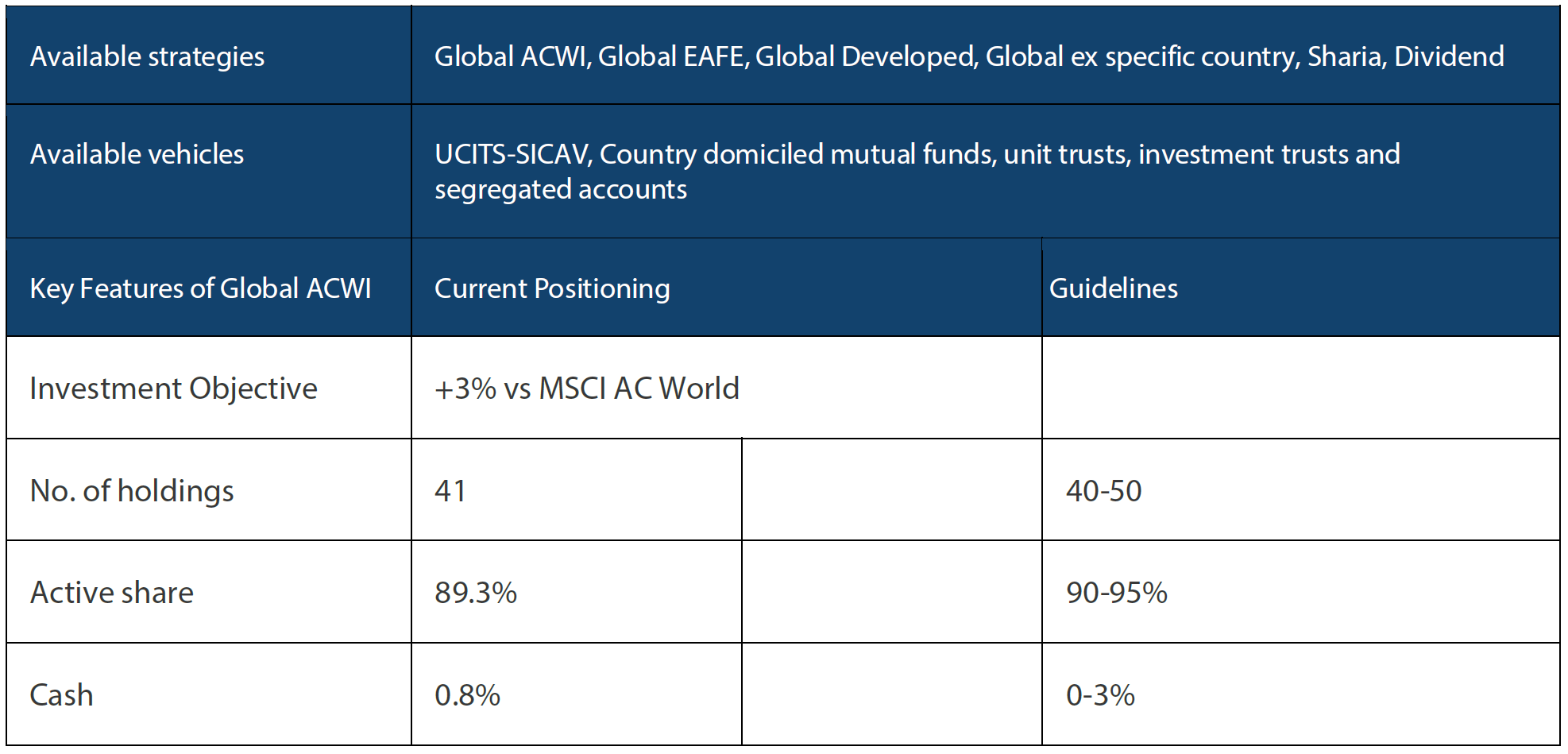

The demand for in person meetings and events is clearly strong. What’s also clear is that there remains a huge stream of new IT start-ups, a theme that has been going on for several years. In fact, over 1,500 start-ups were in attendance, showcasing new ideas and technologies. The flow of capital to new IT companies continues unabated and has done throughout the pandemic. The amount of money, or “dry powder”, sitting on the balance sheets of both private equity (PE) and venture capital (VC) companies is estimated to be over USD 3 trillion, up from USD 800 billion just five years ago.

Chart 1: VC and PE committed capital 2000 to present

Source: Prequin, JP Morgan

This provides a very strong tailwind for new business formation. Our investment in SVB Financial is a play on this trend and is a direct beneficiary of the dry powder available at PE/VC firms. SVB Financial is a niche US regional bank focusing on banking the innovation economy, providing banking services to start-up and early-stage companies in the IT and healthcare industries, as well as providing financial services to the PE and VC firms that finance them. They have a broad range of products, services and deep industry expertise. The “innovation ecosystem” they have created provides a meaningful competitive advantage. As this USD 3 trillion in capital is put to work over the next few years it will generate very strong growth opportunities for the company, in our view.

While this flood of capital is good for SVB Financial it continues to increase competition in the IT sector. Exit markets have been very active over the last few years. Global IPO proceeds are 35% higher than 2020 (through the third quarter of the year). Much of this issuance can be attributed to the popularity of special purpose acquisition vehicle’s (SPAC) in the US, which has accounted for 35% of US volume. IT and healthcare issuance account for over 50% of new IPO proceeds.

Unsurprisingly, much of the discussion at the conference centred around environmental, social and security challenges that the world and corporates face today. None of these challenges are new but regulation and public opinion continues to force change particularly with regards to the environmental and social themes. COP26 was taking place the very same week but I suspect some of the technologies being showcased and discussed at Web Summit will have a far more meaningful impact on environmental change over the next few decades than the pledges and commitments made at COP26. Companies focussing on energy efficiency, waste management and sustainability solutions for businesses will likely provide the tools that are needed to make a real difference. Microsoft was in attendance and discussed the shift to a net-zero economy. They have been a vocal advocate of net zero targets, a pioneer in utilising renewable energy to power data centres and are a member of the hydrogen council. They recently announced the Microsoft Cloud for Sustainability. This is a software-as-a-services solution to allow customers to manage their carbon footprint. A lack of global standards and incomplete and misleading data compromise regulators’ ability to solve this problem alone. Microsoft’s Cloud for Sustainability solution is one of many that help to tackle the problem by first aggregating and analysing more complete data sets, a critical missing link in achieving net zero targets.

The other big conference topic was cybersecurity. Cybersecurity is an immense challenge and ongoing threat to corporates and individuals. The good news is that there has been significant capital entering the space and new solutions and services are being developed. Microsoft has one of the largest security businesses in the world.

They generate over USD 10 billion from security software sales, over two times larger than the largest listed pure play security software company. This is a fast growing part of the business and essential for companies providing cloud solutions. The ongoing threat and evolution of cybersecurity will require continued investment and innovation.

Source: Shutterstock

Another holding in the portfolio, Amazon, provided several workshops explaining and educating on the significantly enhanced set of security solutions embedded in Amazon Web Services (AWS). AWS has evolved dramatically since the early days of basic storage and computer services. Unlike Microsoft, which already had a large suite of customer facing business solutions, Amazon had an infrastructure-as-a-service offering but limited customer facing software. Over the past few years this has changed meaningfully and is an important development in the evolution of AWS. Many potential customers didn’t have the capability or expertise to create, develop or use services and solutions on top of the basic AWS offering. In recent years they have launched Amazon Connect, Amazon Quicksight and significantly enhanced AWS AI and machine learning offerings to name a few.

The other interesting new solutions AWS has recently launched are their edge computing and 5G capabilities, AWS Outposts, AWS Local Zones and AWS Wavelength. These allow Amazon to leverage its global data centre footprint and provide low latency solutions for customers at the edge. The evolution of 5G and IoT has been a slow journey but AWS has a number of solutions to take advantage of this opportunity, providing infrastructure and software that allow for data analysis and processing as close to the user as required. These solutions often require AWS hardware and software being deployed outside of AWS data centres. This evolution of edge computing is the reason American Tower, the global cell tower owner and operator, recently acquired CoreSite Realty, an owner and operator of US data centres. The deal combines American Tower’s Mobile Edge capabilities with CoreSites’s metro edge and interconnection markets—further confirmation that 5G use cases will drive computing power to the edge of the network.

Employment shortage and wage inflation

The only hiccup to the Lisbon event was transportation, as the Portuguese capital’s metro system was on strike for part of the week. Similarly strikes were taking place back home in Scotland to coincide with COP26.

The strikes are a clear signal that the balance of power has shifted to employees. The labour shortage is undoubtably a function of the pandemic. Economic shocks are typically followed by a period of imbalance. Demand has normalised over the last few months; however, supply across many industries has been disrupted. The labour imbalance is at extreme levels. In the US alone there are 10 million job openings but just 7.5 million unemployed. The participation rate remains well below pre-pandemic levels. It’s normal for participation rates to fall during a crisis but it’s uncertain whether we will see many of those that have left the job market return. The average US baby boomer is now 66 and many will have seen the pandemic as an opportune time to retire. Rising asset prices over this period will have boosted pension pots giving an added incentive.

However, falling participation rates are not the only issue: employees are changing jobs at an accelerated rate. The restrictions during the pandemic are largely responsible for this as individuals in industries that were locked down had to seek employment in sectors that could continue unaffected. It’s been dubbed the “Great Resignation”. Monthly voluntary turnover of staff has increased to 3% in the US from closer to 1.5% at the start of the lockdown in early 2020. The number one reason employees are voluntarily leaving is compensation. As a result, this trend is accelerating and will continue to do so until the supply and demand of labour gets back into balance. In addition, new businesses are opening at some of the fastest rates in history. US new business formation is at multi-decade highs and has been since early 2020. Many of these new businesses are presumably chasing the trillions of dollars of PE and VC money discussed earlier.

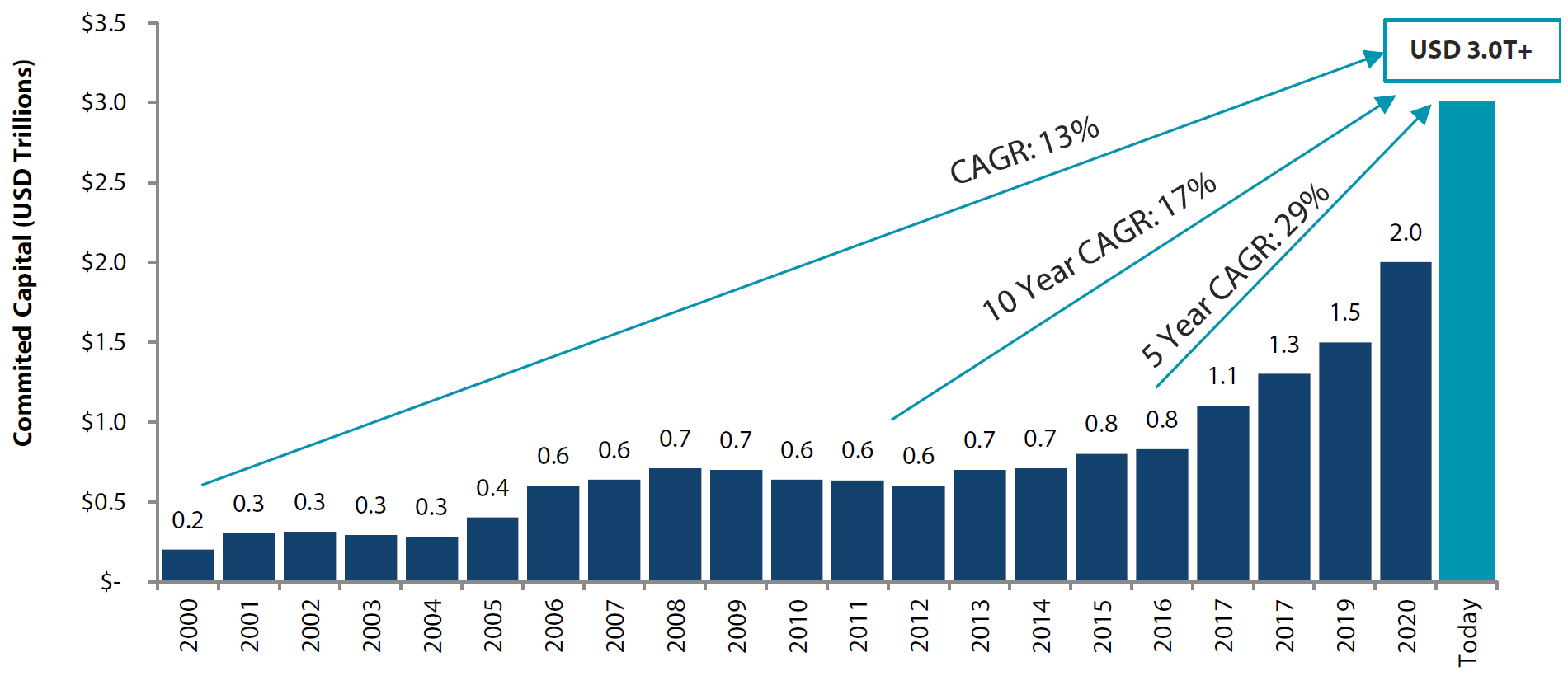

Coaxing people back to certain positions will be challenging. New regulation in the US requiring employers with 100 or more workers to enforce vaccines or weekly testing will compound this problem. Competition for labour from IT companies is also an issue. IT companies took advantage of the lockdown to hire aggressively while parts of the economy were shutdown. For example, Amazon took advantage of the abundance of available labour and has hired more than 850,000 net new workers in the past three years, equivalent to about 5% of total US retail employment. Wage inflation poses a challenge to companies as they try to protect margins and retain talent. The supply disruption, inflation and labour dynamics we are experiencing today have a lot of parallels with those experienced after World War 2. Supply chains and labour markets came back into balance relatively quickly and inflation, while far higher than forecast in that period, reverted to a “normal” level over time. We are already seeing some supply chain normalisation today and while wage inflation is unlikely to be transitory, it shouldn’t disrupt economic growth.

Chart 2: Actual & forecast CPI-U inflation 1946-1953

Conclusion

Regardless of how this plays out, we believe identifying companies that can attain and sustain high cash returns on invested capital with a solid growth profile will serve investors well over the long term. These are companies that may solve the problems we face today. They include environmental and health care stocks, and we continue to have a significant position in the portfolio in these areas. The impact of labour shortages has provided some good opportunities. Encompass Health and LHC are two good examples. They both have exposure to the home health market, but the business models remain very strong; they also have genuine competitive advantages over smaller peers and their valuations are now very attractive. Furthermore, their long-term growth opportunities are strong given the ageing US population, patient preference for treatment at home and strong government policy support (thanks to the lower cost of care at home, relative to hospital or other healthcare facilities). Other key solution providers are companies that we saw at the Web Summit that aid in the digitisation and automation of the economy such as Adobe Systems, Amazon, Accenture and Microsoft. This is an interesting part of the cycle and our valuation pillar is more important than ever when identifying and investing in “Future Quality” companies.

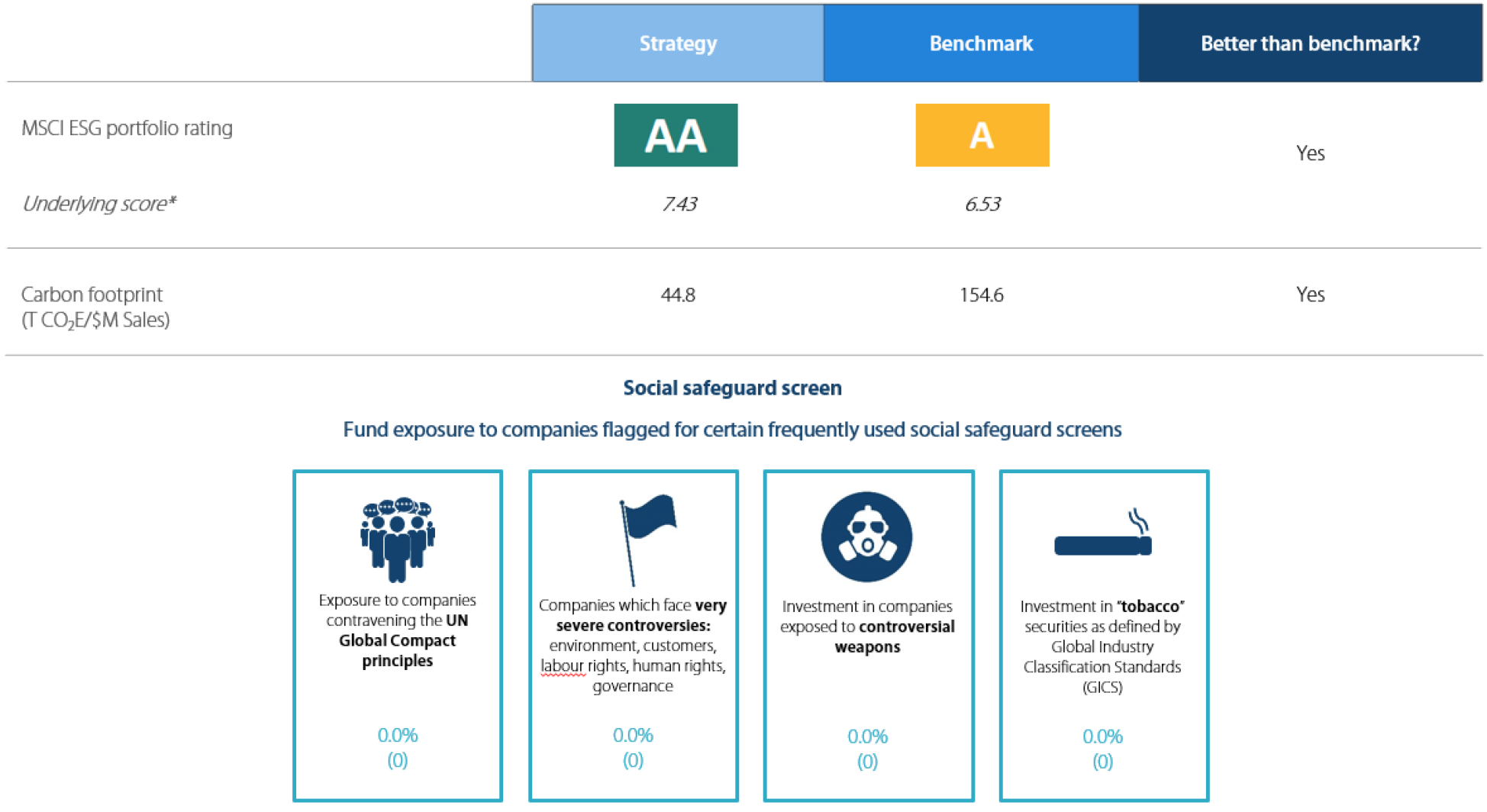

Strong ESG credentials

* Underlying score is the MSCI ESG Quality Score,. Carbon Footprint is Weighted Average Carbon Intensity Data supplied as per the MSCI definitions. Fund is a representative account of the Nikko AM Global Equity Strategy. Benchmark is the MSCI ACWI. Any comparison to a reference index or benchmark may have material limitations and therefore should not be relied upon. Source: MSCI ESG Research September 2021

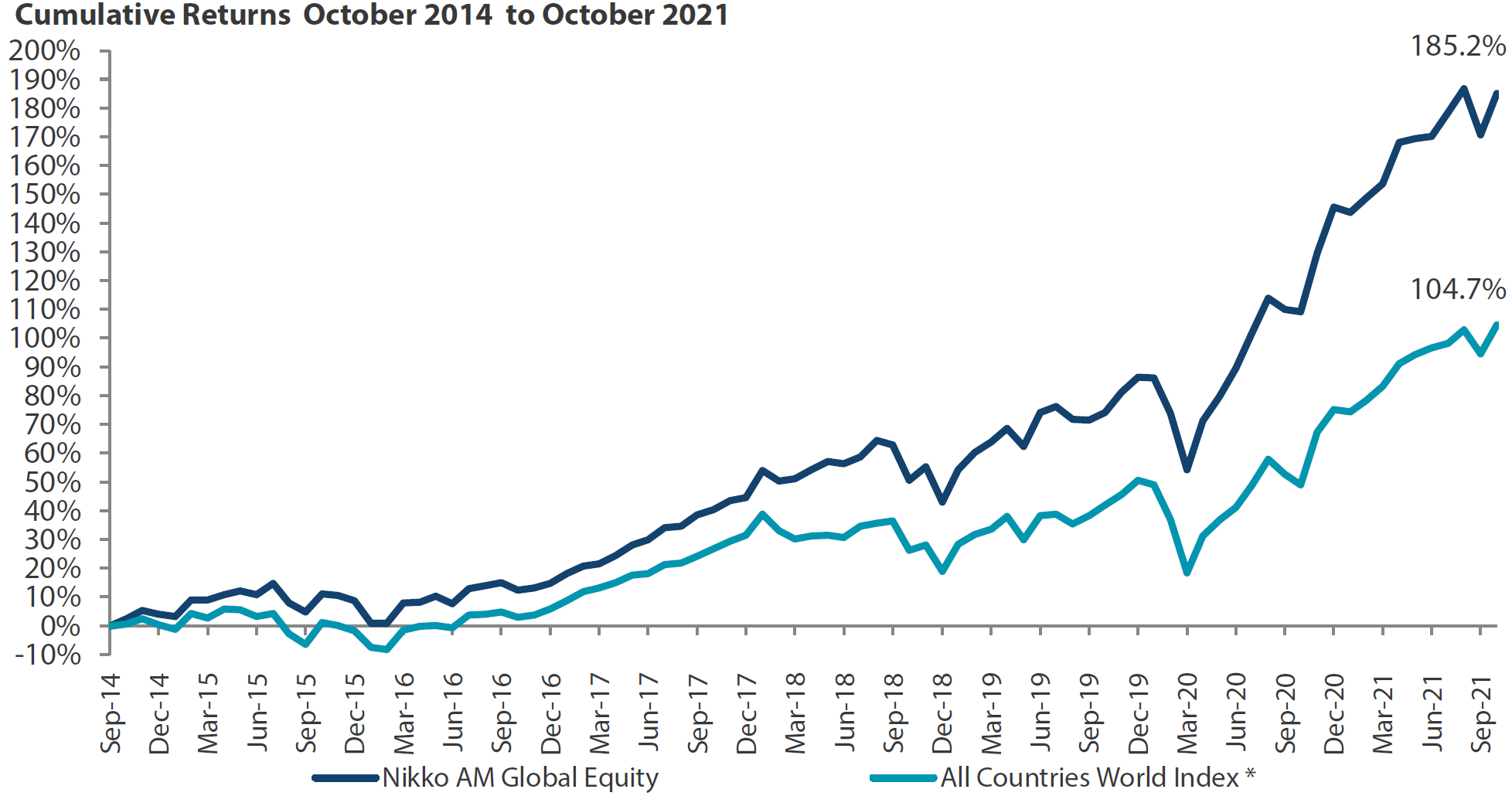

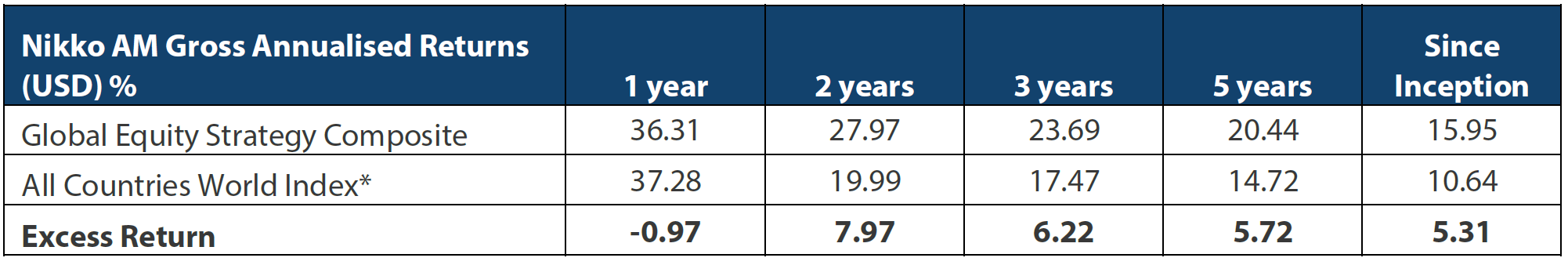

Global Equity Strategy Composite Performance to October 2021

*The benchmark for this composite is MSCI All Countries World Index. The benchmark was the MSCI All Countries World Index ex AU since inception of the composite to 31 March 2016. Inception date for the composite is 01 October 2014. Returns are based on Nikko AM’s (hereafter referred to as the “Firm”) Global Equity Strategy Composite returns. Returns for periods in excess of 1 year are annualised. The Firm claims compliance with the Global Investment Performance Standards (GIPS ®) and has prepared and presented this report in compliance with the GIPS. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Returns are US Dollar based and are calculated gross of advisory and management fees, custodial fees and withholding taxes, but are net of transaction costs and include reinvestment of dividends and interest. Copyright © MSCI Inc. The copyright and intellectual rights to the index displayed above are the sole property of the index provider. For more details, please contact Nikko Asset Management. Any comparison to reference index or benchmark may have material inherent limitations and therefore should not be relied upon. Data as of 31 October 2021.

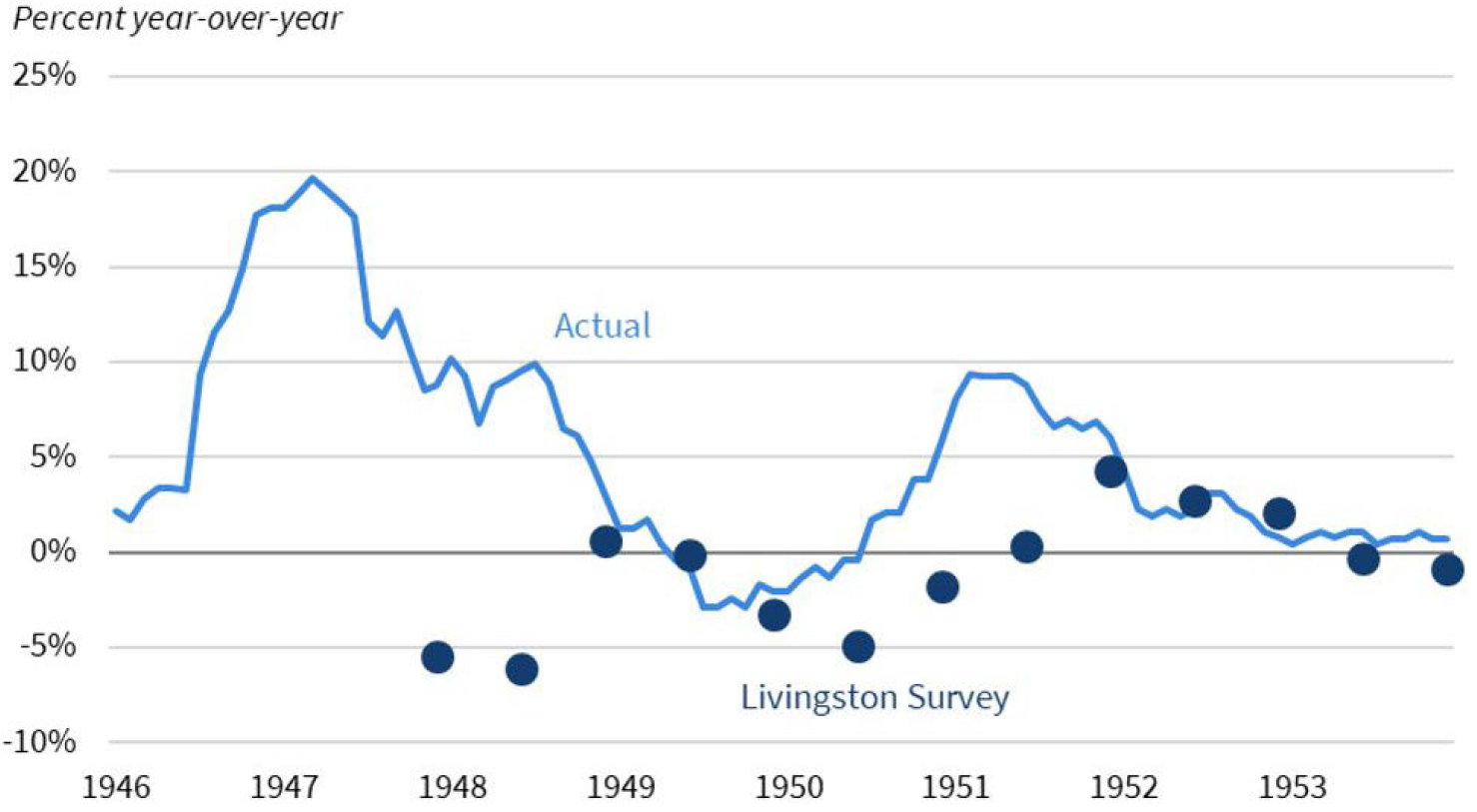

Nikko AM Global Equity: Capability profile and available funds (as of October 2021)

Target return is an expected level of return based on certain assumptions and/or simulations taking into account the strategy’s risk components. There can be no assurance that any stated investment objective, including target return, will be achieved and therefore should not be relied upon. Any comparison to a reference index or benchmark may have material limitations and therefore should not be relied upon.

Past performance is not indicative of future performance. This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). GIPS® is a registered trademark of CFA Institute. Nikko AM Representative Global Equity account. Source: Nikko AM, FactSet.