Will Low Global Equity Investment Director

27 May 2019

Being a parent isn't easy...

We all know it can be difficult. Hugely rewarding and fulfilling but also difficult. We are sure parents all have similar aspirations for their children to be well rounded, considerate members of society who make a positive contribution while truly enjoying whatever it is that they love to do. Yet there are no instructions.

There is no ’user manual’ or a ’quick start guide’. As parents we have to rely on a series of judgements and actions in response to a massively wide range of situations which present themselves daily. Yet parents take these decisions almost subconsciously despite having limited experience and in many cases limited knowledge of what the right thing to do is. Parents may not get it right all the time, but the instinct to respond in line with a set of values helps them make the right call more often than not.

Parents feel as if they are making it up as they go along but we suspect they are mostly doing so within a guiding framework of values. In the early years, the ability to influence is quite high. A mixture of encouragement and discipline helps set the right patterns of behaviour and crucially reinforce a positive set of values. As children become teenagers and young adults, it is natural for the direct influence of the parent to become much less. At this point, when decisions made can have significant consequences, parents hope that the values instilled from a young age help their children make the right choice. Parents can’t control the outcomes, we all know that, but passing on a core set of values hopefully steers things in the right general direction.

You may now be wondering why we are talking about parenting in an investment insight? Well, like many in the industry, the Global Equity team at Nikko AM has been wrestling with what ESG really means to us. The parallels to parenting seem fairly strong. Firstly, if we think about the ability to influence and set ground rules, investors likely have a much greater ability to do so in the early years. If a company is only reliant on a few private investors for funding, their ability to influence the culture and values of a firm is arguably much greater at this early stage.

Source: Shutterstock

Secondly, when the company gets much bigger and is owned by a large number of shareholders, the ability to directly influence and control outcomes can become less. Just like the teenagers facing life’s most difficult choices, the management of these large publicly listed firms which we invest in, must rely on their own culture and values to make decisions which serve the best interests of all the stakeholders in their value chain. These decisions often represent complex judgements which can have a significant influence on the long-term value of the firm, so truly understanding the culture and values which set the framework for such decision-making is a hugely important job for us as investors. The third parallel that strikes us relates to the ‘making it up as you go along’ aspect. ESG is clearly an evolving field and investors are having to respond as they reflect on shifting attitudes in society as a whole.

In the eight years that we have been investing together as a team, we have always placed great emphasis on the culture and values aspect of our investments. We look for businesses that can attain and sustain high returns on capital for the long term. How management teams act to allocate capital, govern us as shareholders, retain and develop people while keeping their financial incentives aligned with us as shareholders are critical factors in our assessment of management quality.

As part of our assessment of where we stand on ESG, we recently employed a third-party researcher to assess how our portfolio looks relative to our industry peers on Environmental, Social and Governance factors. We were pleased that our long standing due diligence around Governance meant that our portfolio has consistently scored in the top quartile relative to peers in this area. We seem to be doing a good job of finding companies with good oversight and values which broadly align stakeholder interests for the common good. We feel this is no less than our investors should expect. Finding quality companies that can attain and sustain high returns for the long term requires a foundation of the correct values which guide companies to do the right thing for the long term.

Perhaps more surprising was the finding that our portfolio of companies also ranked amongst the very best in our peer group when it came to its overall carbon footprint. Our bottom up search for companies that can earn high returns on capital and sustain these returns for the long term has naturally led us to invest in companies which have low levels of capital intensity and participate in the growing service sectors of the varying economies around the world where we invest. While it may not have been our specific intention at the outset, our philosophy has proven well aligned with finding businesses which can minimise their use of the planet’s precious resources. Hopefully a happy outcome for all concerned and one that we would expect to continue.

But what of Environmental and Social factors specifically? Where does our Global Equity Portfolio rank in this regard? Well, the scores were good but only just above the average compared to our peers. Like the parents in the example at the start of this article, the active management industry (ourselves included) is having to adapt to a changing set of circumstances. Effectively ‘making it up as it goes along’ within a framework of values which is clearly evolving. We are no different and we are evolving our assessment of these factors at the stock specific level. It’s fairly clear that society’s views are evolving too. Social and environmental behaviours have been changing from generation to generation, but it now appears that this change has reached a tipping point. Consumers are increasingly making choices based on brands and companies that do the right thing from an environmental and social point of view and it is increasingly clear that investors are likely to do the same. It is arguable that investors have tended to use ESG as a form of risk mitigation. If there was good governance and an understanding of the social and environmental risks, investors were likely to tick the box and believe that they were largely protected as shareholders. Increasingly however, Environmental and Social factors and how companies respond and deal with these challenges can go right to the heart of the long-term franchise value of the business. It can be a threat but it can also be an opportunity and it is our role as investors to understand these issues and find businesses that can benefit from them to not only sustain their high returns on capital but also to serve society in the right way while doing so.

Parents are rightly proud when their children flourish and become the responsible adults they hoped for. We hope that our bottom up approach to ESG investing will allow us to invest in companies who are similarly successful over the long term. With a focus on the culture and values of the businesses we invest in and a deeper understanding of how they might approach environmental and social factors in a way which benefits all stakeholders for the long-term, we aim to be the responsible investors our clients wished for at the outset also.

The Spice of Life

The astute reader will have observed that your author this month has the honour of living with teenagers. It’s an important time for these young adults in the UK as the regular diet of important exams approaches. This often coincides with something of a spring heatwave – just to compound the misery of enforced study. This year was no exception so we recently took the opportunity to host a barbecue at our house to bring these young folks together and let off a little steam heading into the exams.

The teenage hoard descended and proceeded to eat us out of house and home. They were polite but they were also clearly hungry. What surprised us though was their collective desire to add all sorts of spicy seasoning and sauces to our barbecued offerings. Maybe it was our rather average barbecue ability that forced them to reach for the spice rack but we couldn’t help but reflect on how much people’s palates change from generation to generation. We eat differently to our parents and so it would seem will the next generation. An increasing demand for spice seemed the obvious conclusion.

Such a growing demand for spice and seasonings lies behind our addition of McCormick to the portfolio in the first quarter. This is a global leader with 20% market share which is five times the size of its nearest competitor. Changing tastes in developed markets as well as consumption growth in emerging economies should allow the company to grow organic sales at around a 4% compound annual rate for the long term. Their recent acquisition of iconic brands such as Frank’s RedHot pepper sauce and French’s mustard from Reckitt Benckiser is also supportive of margins and the business earns a return on capital of around 24%. These are excellent metrics relative to a consumer staples industry which often must battle against changes in consumer tastes and new forms of distribution. The work McCormick does on ethical sourcing and to improve the economic interests of the small farmers in their supply chain also places McCormick as best in class in the industry. Please be sure to have plenty of McCormick’s products to hand the next time a large group of hungry teenagers turn up at your door.

Source: Shutterstock

Compelling content?

Where would we be without Adobe? You wouldn’t be reading this for a start! Millions of us around the world open up attachments with the ubiquitous Acrobat reader every day. Standing out from the crowd can be nigh on impossible but the innovative use of Adobe products can certainly help make things a little more interesting. The good news is there is a whole lot more to Adobe than just the part we see at the bottom of emails every day. Adobe’s Creative Cloud based service helps businesses of all sizes create marketing campaigns that get their messages across in innovative and efficient ways. Its popularity with its creative client base and efficient cloud based delivery platform gives Adobe a significant competitive advantage as customer loyalty is incredibly high. These new products are dramatically expanding Adobe’s addressable market and the boom in digital advertising is driving strong growth and high returns which seem sustainable for the longer term. This prompted us to add Adobe to the portfolio in Q1 as we continued to reduce our position in Red Hat following its acquisition by IBM.

Source: Shutterstock

Reference to individual stocks does not guarantee their continued inclusion in the strategy’s portfolio, nor constitute a recommendation to buy or sell.

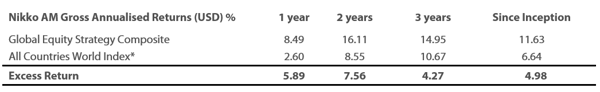

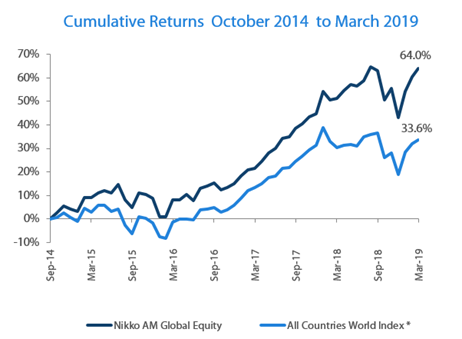

Global Equity Strategy Composite Performance to Q1 2019

Past performance is not indicative of future performance. Source Nikko AM, FactSet, Bloomberg

The track record for Nikko AM portfolio is based on a composite portfolio from 01 October 2014 to 31 March 2019. *The benchmark for this composite is MSCI AC World Index. The benchmark was previously the MSCI All Countries World Index ex AU since inception of the composite to 31 March 2016. Returns are US Dollar based and are calculated gross of advisory and management fees, custodial fees and withholding taxes, but are net of transaction costs and include reinvestment of dividends and interest.

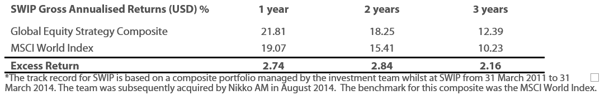

*The track record for SWIP is based on a composite portfolio managed by the investment team whilst at SWIP from 31 March 2011 to 31 March 2014. The team was subsequently acquired by Nikko AM in August 2014. The benchmark for this composite was the MSCI World Index.

Nikko Asset Management New Zealand Limited (Company No. 606057, FSP22562) is the licensed Investment Manager of Nikko AM NZ Investment Scheme, Nikko AM NZ Wholesale Investment Scheme and the Nikko AM KiwiSaver Scheme. This material has been prepared without taking into account a potential investor’s objectives, financial situation or needs and is not intended to constitute personal financial advice, and must not be relied on as such. The Product Disclosure Statements are available on our website: https://www.nikkoam.co.nz./invest/retail.

.jpg?width=754&name=iStock-859680464%20(1).jpg)